What we need from you. STAMP DUTY is applicable.

.png)

The World S Largest Manufacturer Of Glove

Therefore the details of the specific restrictions on the transfer of shares must be stipulated in the constitution.

.png)

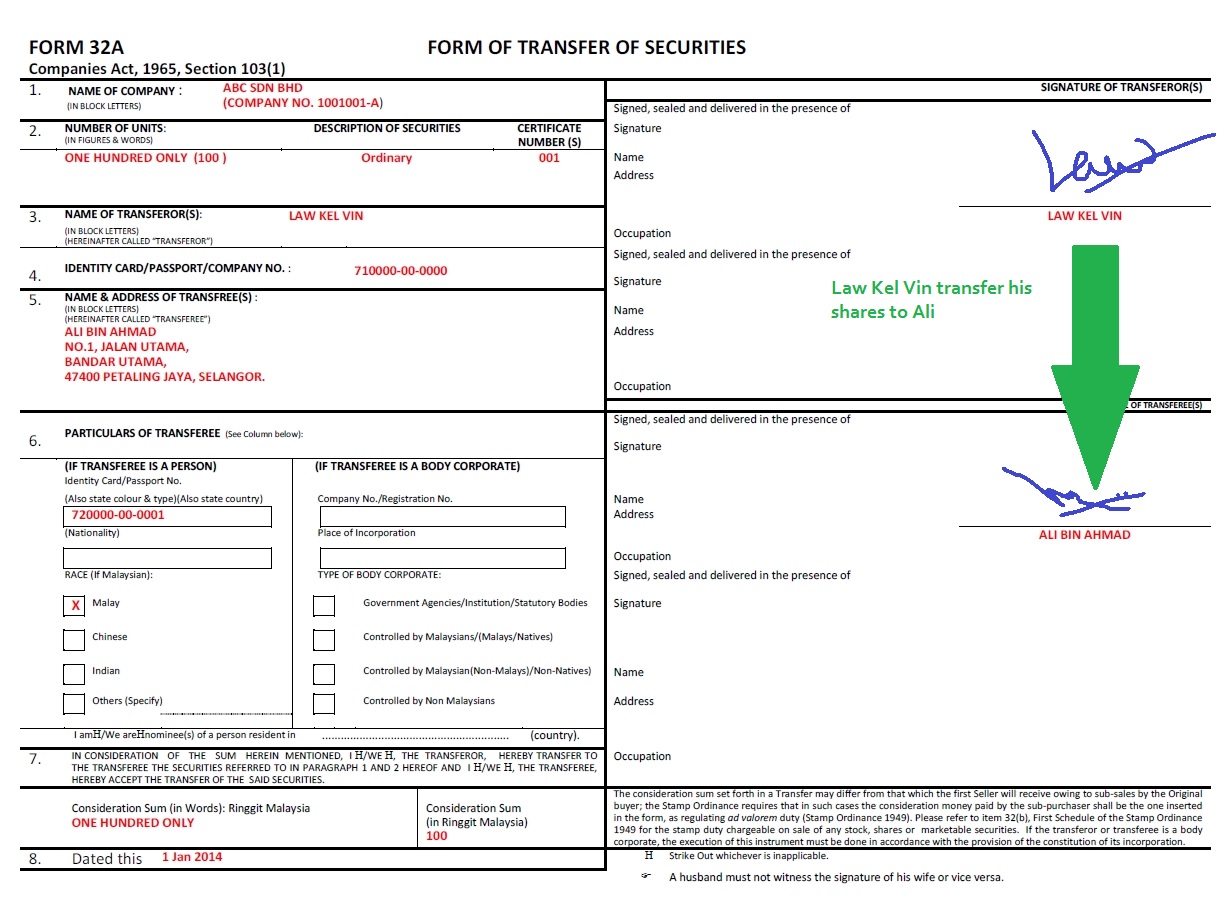

. Click the Form to See Large Image. Whether youre a trader or investor this guide explains how much. In order to transfer shares in a sdn bhd company from one person to another person in Malaysia the following documents are needed to complete the shares transfer.

Shares buyer to transfer the money to the shares seller directly. The issue of shares when shares are to be acquired in the transferee company to the holders of shares in the existing company in exchange for the shares held by them in the existing company. A share is a security which represents a portion of the owners capital in a business.

The approval of the collector of stamp duties is required and anti-avoidance provisions under section 15 may claw back the stamp duty relief if granted under certain. Procedures to Transfer of Shares of Malaysian Company. We have noticed an unusual activity from your IP 2074613122 and blocked access to this website.

In consideration of the sum herein mentioned IWe the Transferor hereby transfer to the Transferee the securities referred to in paragraphs 1 and 2 hereof and IWe the Transferee hereby accept the transfer of the said securities. Depending on the amount purchased the businessmen can become minority or majority shareholders. The performance of the business can often be measured by the amount of dividends shareholders receive and by the price of the share quoted on the stock market.

A company is having 100000 ordinary shares with its par value at RM100 each. In Malaysia although a private company is required to restrict the transfer of shares Section 42 2 there is no specific provision regarding the restriction on the transfer of shares. For that once the directors had made up their mind in shares transfer.

Consideration Sum in words. We want to give you the basic and honest facts about registering a sdn bhd company in Malaysia and all of the information can be confirmed at ssm. Home Form 32A Share Transfer Form.

Depending on how often you trade shares and how the Inland Revenue Board Of Malaysia IRBM classifies you you might need to pay tax on the profits or gains youve made or you could be eligible for a tax exemption. Shareholders are the owners of the business and share the success or failure of the business. That company is having total shareholders fund of RM450000 as at the end of last year.

Offer Price RM980 2. Section 105 FORM OF TRANSFER OF SECURITIES. Secretary to prepare board resolution Form 32A The Company Secretary will at the request of the directors to prepare the Board Resolution for directors to approve the transfer of shares and the Form 32A to be signed by existing shareholder new shareholder for the relevant shares to be.

Stamp duty for transfer of shares Malaysia Section 1051 of the Companies Act 2016 required any shareholder or debenture holder may transfer all or any of his shares or debentures in the company by a duly executed and stamped instrument of transfer and shall lodge the transfer with the company. The Share Transfer Form Form 32A need to be witnessed by someone not wife or husband The shareholders need to pay stamp duty for the shares transfer The stamping on Form 32A will be done at any LHDN office. Boards Resolution Approval from the Board of Directors to accept the transfer of shares.

Par Value RM100. The section states that subject to other written laws any shareholder may transfer all or any of his shares in the company by a duly executed and stamped instrument of. Please confirm that you are not a robot.

2 Method to Transfer Shares. Under the Real Property Gains Tax Act 1976 RPGT Act an RPC is a controlled company which the defined value of its real property or shares in another RPC or both is at. The 10-page 2019 Guidelines replaced the earlier Guidelines on the Stamping of Share Transfer Instruments for Shares that are not quoted on the Kuala Lumpur Stock Exchange 2001 Guidelines and were effective from 1 June 2019 until 29 February 2020.

In Malaysia the Companies Act 2016 CA 2016 recognises the distinction between transfer and transmission of shares. Its tax time again which means a couple of things if you trade shares in Malaysia. The new 13-page 2020 Guidelines which are effective from 1 March 2020 replace and cancel the 2019 Guidelines.

The stamp duty payable is therefore calculated based on par value ie. Value of shares transferred RM091 x 150000 RM136500 C Sale consideration RM75000 A comparison between Par Value NTA and sale consideration shows that the value of shares based on par value is the highest. For shares transfer stamp duty will be calculated by 1 by LHDN and upon completing the process the authority LHDN will be generating a stamping certificate as a proof or cleared payment.

Actual Value RM450 Shareholders Fund divided by total shares The stamp duty for transfer of 50000 ordinary. The transfer of shares in Malaysia has to be completed following the provisions stated by the Companies Act Section 103. Finally the SECTION 105 FORM will be delivered to.

The calculation of the shares value will be as follows. It restricts the transfer of its shares s422 It cannot offer its shares or debentures to the public s431. Ringgit Consideration Sum In Malaysian Ringgit RM 8.

Although capital gains are generally not taxed in Malaysia one exception to this is the gains arising from the disposal of either real property OR shares in a Real Property Company RPC. All transfer of shares are subject to approval from the Board of Directors. A transfer of shares is prescribed under section 1051 of CA 2016.

It cannot allot shares or debentures with a view of offering them to the public s431. The following are step-by-step guide for the transfer of shares in a company. Form 32A Share Transfer Form.

Under s151 of the CA 1965 a private company was prohibited from inviting the public to subscribe its shares or debentures.

Latest Market Research Reports On Top Industries Aarkstore Com Retail Banking Banking Marketing

Craft Tip Use Fabric Crayons To Transfer And Duplicate Patterns The Zen Of Making Sewing Techniques Sewing Hacks Sewing Tutorials

Suren Holidays International Travel Destinations Travel Hotels Tour Packages

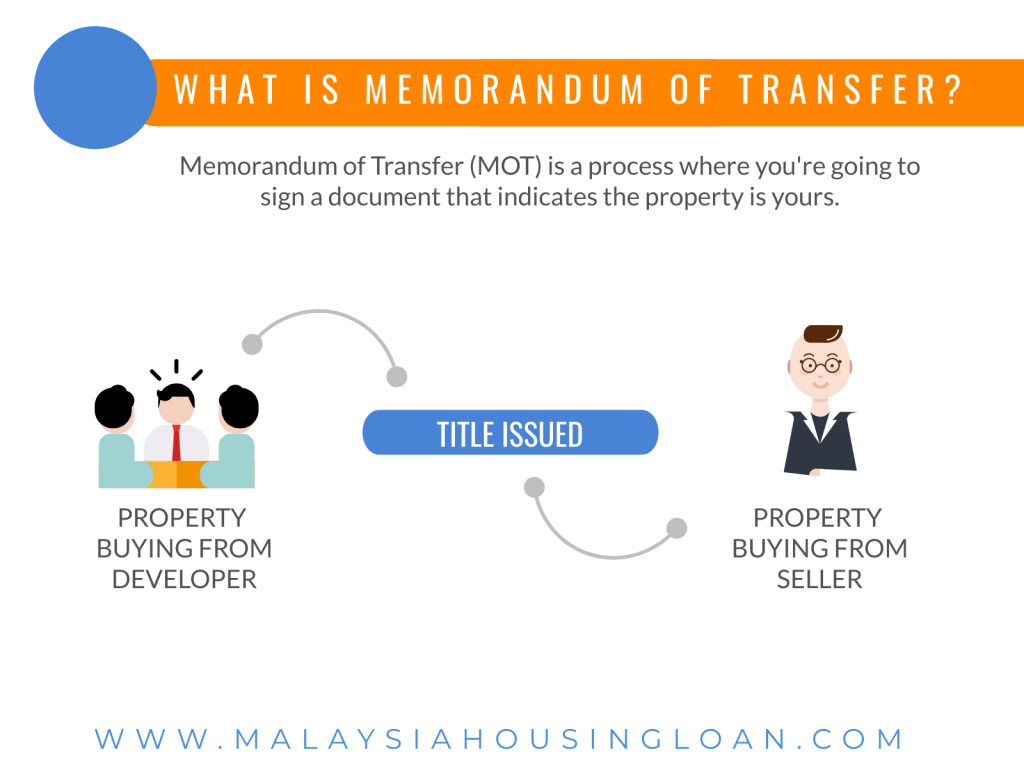

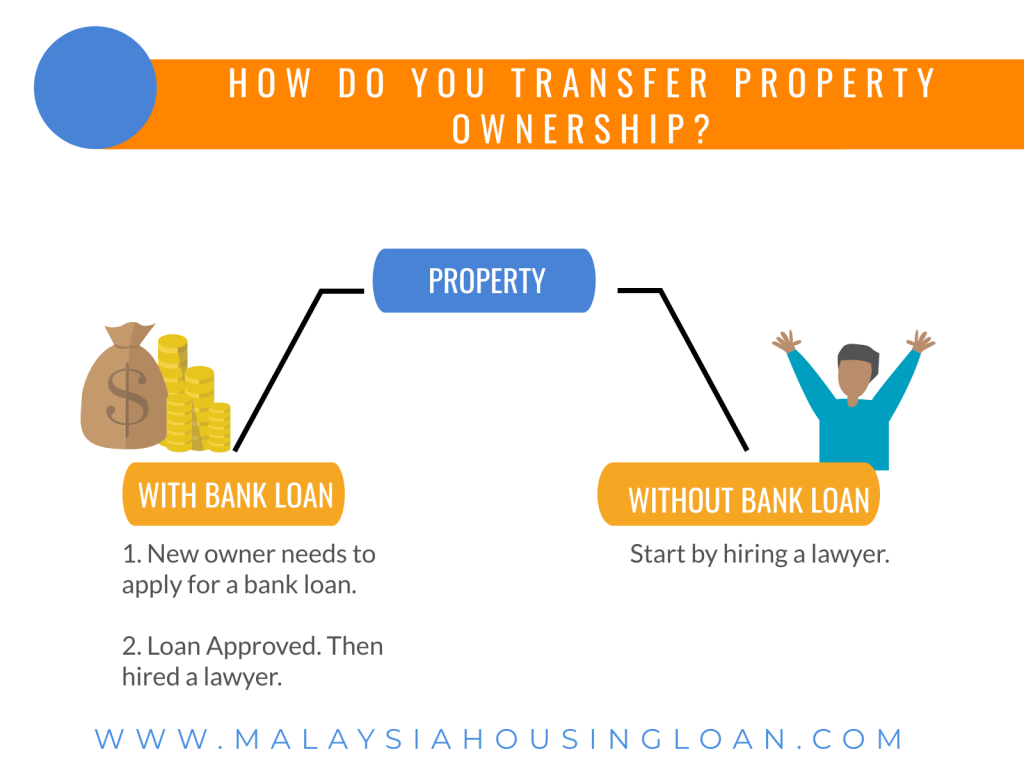

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Don T Forget Cricut Supplies Card Stock Heat Transfer

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

Sample Letter Of Intent Letter Of Intent Letter Example Letter Sample

Issuance Of Share Certificates Case Facts By Hhq Law Firm In Kl Malaysia

Freehold Vs Leasehold Freehold Common Myths Home Buying Tips

Memorandum Of Transfer Malaysia 2022 Malaysia Housing Loan

10 Things Nri Should Know About Portfolio Investment Scheme Pis Nri Saving And Investment Tips Investing Investment Tips Savings And Investment

Van Aken Kato Polyclay White 12 5 Oz Block Etsy In 2022 Kato Polyclay Color Mixing Kato

Form 32a Share Transfer Form Company Registration In Malaysia

Solved Which Of The Following Best Describes A Best Efforts Underwriting Commitment Review Later Ume Full Fina Nsibility F Underwriting Solving Accounting

Contactless Mobile Payment Mobile Payments Logo Online Shop Concept Art Characters

.png)

The World S Largest Manufacturer Of Glove

Rasa Malaysia Giovanni S Shrimp Scampi Copycat Recipe Couldn T Navigate The Website Through All The Pop Recipes Shrimp Recipes For Dinner Shrimp Scampi Recipe